Home potential buyers really should make certain They can be investigating homes within USDA-qualified geographic spots, as the residence location is The key aspect for this loan sort.

VA – VA loans are zero-down loans which are assured from the U.S Division Of Veterans Affairs. To qualify to get a VA loan, you must be considered a recent or previous service member. All those with suitable company get ultra-minimal mortgage charges and don’t have to pay month-to-month mortgage insurance plan.

Homeowners are strengthening rather then shifting owing to file small personal loan rates and tougher mortgage lending rules, In line with Sainsbury's Lender

Bridge In the best environment of new home purchasing, your outdated house would market at the exact same time that you choose to purchase your new home. That doesn’t come about way too frequently. A bridge loan aids go over expenditures among buying a home and providing An additional.

• Disabled Earth is strictly a news and knowledge Web site delivered for normal informational function only and doesn't represent clinical suggestions. Resources presented are under no circumstances meant to get a substitute for Qualified health-related treatment by a certified practitioner, nor need to they be construed as such.

You will need to supply several of your Call data to start the method. Vylla also offers a chance to seek out homes via its Web-site, which can further streamline the purchase procedure to suit your needs.

Be ready to reply some Preliminary questions on your economical circumstance. Most lenders will focus on:

Bear in mind, the appraisal differs from an inspection. The appraiser checks basic performance of the home’s systems. If there are severe challenges that impact the program features, the appraiser gained’t know.

Click below to apply for 0 down home loan programs ohio

Also, It's important to pay out mortgage insurance policies, which can boost your regular payment and the general cost of the loan.

Certainly. To qualify, the borrower need to at the moment Possess a USDA loan at this time and should are in the home. The brand new loan is subject to your standard funding fee and once-a-year charge, identical to buy loans.

HUD reported government agencies need to document that they are supporting borrowers obtain home only within their jurisdictions. Tribal governments, it explained, may well only supply guidance to customers living on tribal land or somewhere else.

If a USDA loan isn't a terrific in good shape, you always have the option of seeking into other specialized borrowing products and solutions like FHA loans and VA loans. In the event you’d wish to see what your possible payment can be with USDA loans, a mortgage calculator may also help.

Sellers can usually give in between 3% and 6% on the home’s order price to include the buyer’s charges. These cash can’t be placed on the down payment, but can reduce or do away with any want to come up with closing prices.

The situation couldn't be greater for what we ended up on the lookout for. At any time I've a brief stroll to Portillo's it is an efficient issue. A Exclusive shout out to Santiago, thanks for all your aid.

The only real problem? A twenty% down payment was way out of attain for your couple. The truth is, As outlined by Mason, even a medium-sized down payment might have set them “in a very money pickle.â€

The prices with the 502 Rural Development Assured Loan are based on the mortgage lending providers that associate with the USDA. Nonetheless, the government's guarantee over the 502 loan lets the lenders demand decreased premiums than for standard mortgages. Other deciding variables that impact a guaranteed loan borrower's particular person mortgage charge involve credit heritage and marketplace problems.

The Keystone Home Loan program has income and purchase selling price limitations, in addition to a to start with time homebuyer requirement unique to each county.

Just don't forget, if you do obtain a mortgage, produce a prepare for the way you are going to pay back People payments and keep track of your approach employing a Instrument like ReadyForZero.

The borrower’s household can’t exceed the Formal very low-cash flow limits for the area, which can change by locale and point out.

Guaranteed Loan: The confirmed loan choice has far more generous eligibility rules compared to here the direct loan, which include a greater earnings Restrict than the immediate alternative.

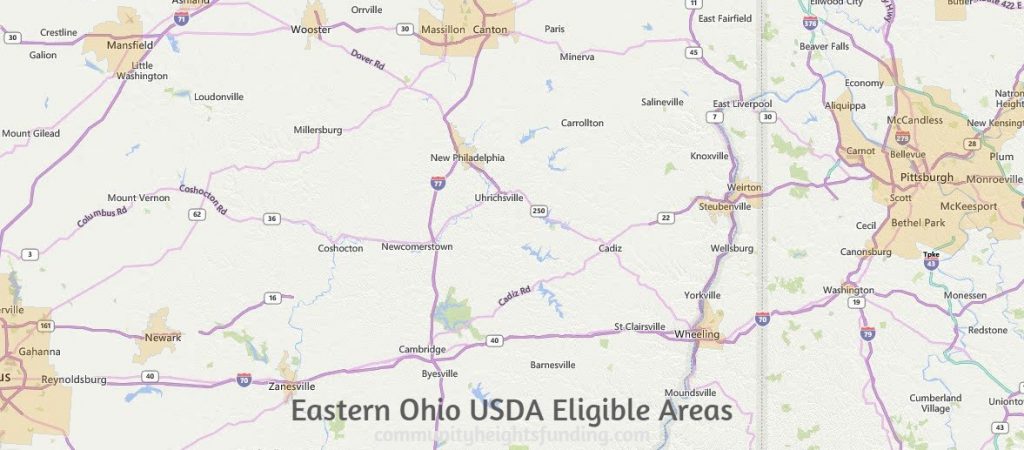

USDA Loans Eligibility In Ohio

Be sure to also Be aware that these kinds of substance is not really updated on a regular basis Which many of the data may not consequently be existing. Check with with your individual financial Qualified and tax advisor when earning decisions regarding your economic circumstance.

Applicant Requirements: The USDA assured and immediate loans start out with comparable specifications, however the immediate loan program has numerous additional rules. These loans are meant for two distinctive teams, so it is important to be aware of which would be the best choice for both you and your spouse and children.

Keep the personal debt-to-income ratio minimal. Your personal debt to income is the percentage of one's revenue that goes to paying expenses. Qualifying ratios are 29 % for housing fees and 41 per cent for complete personal debt. In some cases, lenders can request an exception to permit for a greater ratio.

more durable necessities from a lot of lenders. Probably possessing learned from the money crisis of 2008, many lenders have tightened their lending benchmarks.

When really should I lock my mortgage amount? How to buy a mortgage and Look at mortgage fees Don’t take your very first mortgage fee estimate Precisely what is a mortgage amount lock? five strategies to acquire a decreased mortgage amount thirteen Distributing Remaining Application Things for the Lender

VA loans don’t employ the “best/bottom†personal debt-to-money Investigation that most mortgage programs aspect. In its place, they use a mix of residual earnings and a “base ratio†of 41%.

The purchase price is usually a thing that might be negotiated. You'll be wanting to lock in the purchase cost at the time you indication the lease. The option charge is typically compensated to lock in that selling price and it helps decrease your down payment.

Mortgages also are employed over the industrial facet to buy industrial properties, Workplace House or other types of business property.